| TravelOnline in partnership with Dragonpay and BillEase brings travel more convenient this holiday season .

First-ever installment madness promo happening on the following dates:

During the promo periods Merchants TravelOnline will offer customers a 0% installment plan for up to 6 months with a required upfront payment of only 1/3. All customers, new or old, may avail of the 0% interest. If your approved cash loan amount is lower than the travel package you are trying to book, the difference must be paid in cash directly to TravelOnline. For example, Travel Package Cost P31k Approved loan is only P30k. You will have to pay the 1k difference via cash directly to TravelOnline The P30k can be paid via bill ease approved credit loan. BillEase will ask for an upfront payment of (1/3) Php10k and the 20k balance can be paid at no interest with a monthly installment of 3333 per month – 6 months term. Customers will be instructed by BillEase on how to pay the 1/3 amount. See this link: https://billease.ph/blog/how- NOTE: INSTALLMENT PROMO OPTION IS ONLY APPLICABLE FOR TRAVELONLINE PACKAGES or travel agent assisted packages. Not Applicable on online booking promos or Cash base Discounted Promos. |

What is BillEase?

BillEase is a hassle-free digital credit app that allows your customers to shop now and pay

later online even without a credit card. The user-base count of BillEase as of Mar 2020 is 300k

users.

How can customers apply for the BillEase installment plan?

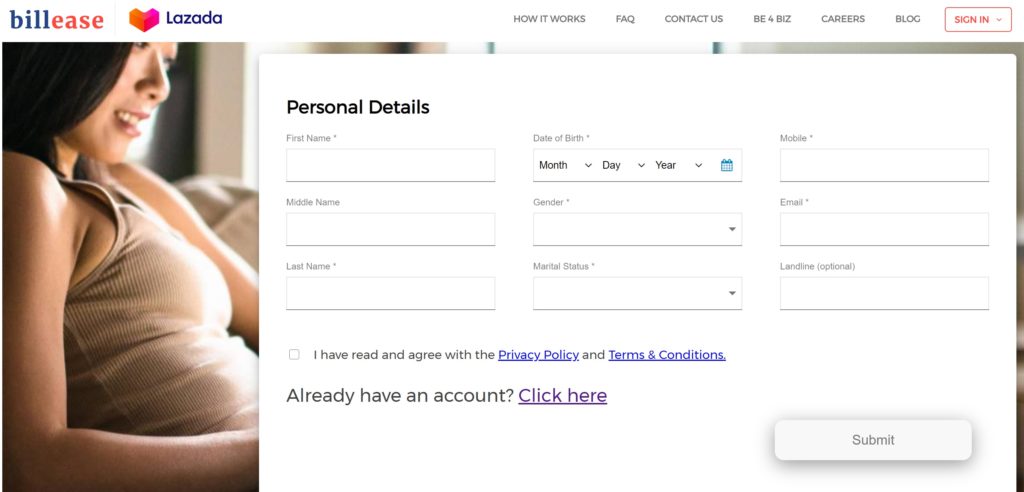

Simply fill out our online application form or download our app and submit the required

documents: 1) valid government ID, 2) proof of billing, and 3) proof of income.

Accepted Proof of Income

• Payslip

• Bank Transaction History (Screenshot)

• Upwork Certificate of Employment (Screenshot)

• Paypal Transaction History (Screenshot)

• Remittance Slip

Accepted Proof of Billing

• Meralco

• Credit Card

• Water

• Cable TV

• Postpaid Plan

What if the Proof of Billing is not under their name, can they still apply?

Yes, they accept a proof of billing even if it’s not under the customer’s name. As long as it is

recent and has their home address, it will work.

Accepted Valid IDs

● Passport

● Driver’s License

● Professional ID (PRC)

● Voter’s ID

● GSIS E-Card

● SSS ID

● Senior Citizen ID

● Immigration ID

● Unified Multi-Purpose ID (UMID)

● NBI Clearance

● TIN ID

● Integrated Bar ID

Is there an age requirement to avail BillEase installment plan?

Anyone who is at least 18 years old and has a stable source of income, is welcome to apply!

Can a freelancer apply?

Freelancers and those who are in the gig economy are welcome

to apply. They can submit to their PayPal transaction history,

Upwork Certificate of Employment, bank transaction history, etc.

How long is your processing time?

The approval is instant but real time approval depends on documents submitted. A response

can be expected from us within 1 banking day.

Just make sure to submit the online application before 6:00 PM because any application

beyond that will be considered as next day submission.

All applications submitted after 8:00 AM on a Sunday will be processed together with all the

Monday applications on Tuesday. This allows BillEase’s credit team to fully verify the

information provided and make better credit evaluation for everybody.

What is the average approved loan and loan tenor?

The initial approved amount for first time applicants ranges from Php 4,000 to 10,000. The

average credit limit existing users is P20,000-P30,000 and about 28% of their customer base

have a P40,000 credit limit.

What are the fees associated with Billease?

Interest Rate starts at 2.5% per month with initial term of 3 months.

Their app which is available on App Store and Play Store is

gamified, meaning customers are encouraged to do re-transaction to

unlock certain features such as 1-12 months payment terms and

credit limit up to P60,000.

What’s the minimum and maximum amount of purchase?

The minimum for purchase is Php 500 and the maximum depends on how much is approved

for their loan.

How can they make payments?

Customers can pay their installments through their Coins.ph account or by Electronic Fund

Transfer (ETF) to BillEase’s bank accounts (BPI, BDO, Security Bank). We also accept

payments at 22,000 non-bank outlets (7eleven, Cebuana, MLhuillier) nationwide.

Is there any penalty for late repayments?

BillEase collects 50 pesos per day if there is a delay on payments as stated on Promissory

Note and Disclosure Statement (PNDS). There is a grace period of 2 days.

How can customers increase their credit limit?

Our system will upgrade the limit based on how well users service their existing installments.

To get a higher limit, just keep using BillEase and pay installments on time.

NOTE: The client must pay the difference If the approved Loan amount is not enough to cover the cost of the travel package that you chose. Clients who wish to book as a group may apply individually then use the total combined approved loan to pay for a group package.

Step 2 : BOOK and PAY using Bill Ease Approved Credit loan

Once Approved pls Contact TravelOnline to book your travel Package.

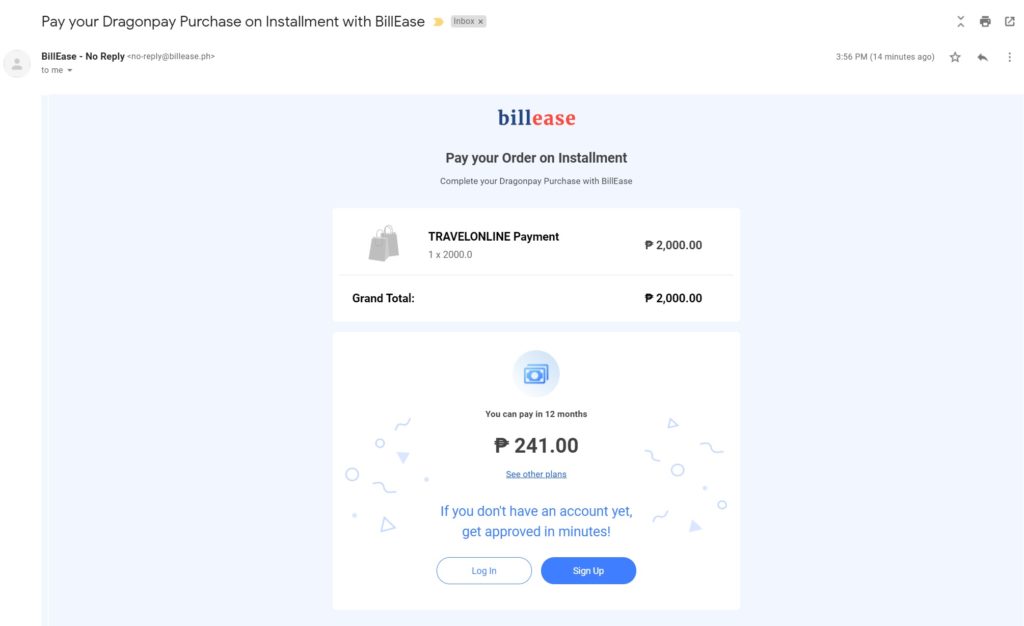

Once your booking is reserved TravelOnline will email you a dragonpay bill . Pls choose billease credit as your form of payment using your approved Bill Ease Credit . Pls log in to your Bill Ease account .

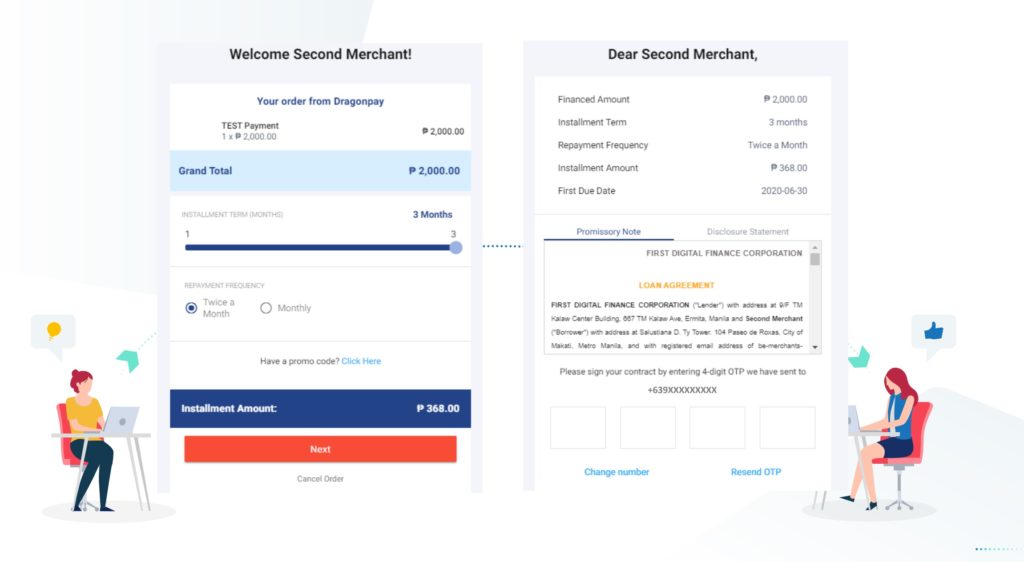

Choose your repayment schedule. The breakdown of your payments will appear based on the number of months by which you wish to complete your payment. Click ‘Confirm Purchase’ to proceed. Interest rate applies and the rate vary on the number months term you choose after check out.

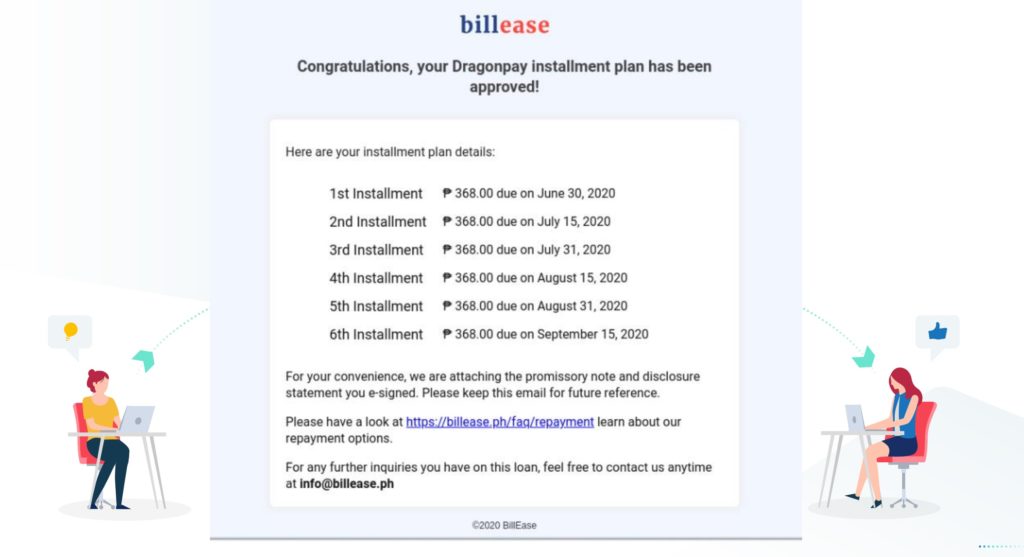

A window will appear confirming that your payment was successfully processed. You will receive a payment confirmation email from Dragonpay as proof of successful transaction and BILL EASE will also send you an email indicating your payment schedule.

Step 3 : Repay your Travel Credit Loan

For more information regarding repayments, you may read Bill Ease Repayments info page.

IMPORTANT NOTES: TravelOnline is the provider of the Product For Sale which is a “Vacation Package”. All bookings are non refundable and non-re-bookable. Borrower will still have to repay the loan to lender even if you decide to cancel the booking. If for any reason a refund is due to the customer TravelOnline will issue the refund directly to BILL EASE. The Borrower will still have to pay for the loan interest rate and any nonrefundable portion directly to BILL EASE. TravelOnline Packages have free Travel Insurance and if you have valid Insurance claim the insurance payout will be issued directly to the customer.

Any Loan concerns pls contact BILL EASE email: info@billease.ph and any travel related concerns pls contact TravelOnline. Pls take note that TravelOnline is not in-charge or responsible for the Loan Approval or Collections .

Loan is approved and financed by a 3rd party lending company BILL EASE. The Borrower must coordinate and pay the Travel Credit loan back to BILL EASE directly.

Please DO NOT borrow money unless you can pay it back. Please take note that just like Banks , lending companies and friends that failure to Pay the money that you borrowed will get you many unwanted collection calls, text, visits, letters, email , late fees, you will also be banned on getting any loans in the future and you will face legal consequences. Please take note that all TravelOnline is not in anyway part of the Collection process and only serves as the provider of the product for sale . Example If you borrow Money to buy a cellphone and failed to Pay you will face legal consequences from the person or company where you borrowed the money to buy the cellphone and not the cellphone company.

NOTE: One account is entitled to one installment transaction at a time, you can make another purchase only after you have settled your previous loan. Once payment for a loan is completed, your account would automatically be entitled again for a new loan transaction with an increased credit limit. Keep using your loan credits in order to increase your credit limit for your succeeding transactions.